I don’t know where we are in the AI hype cycle, but I feel confident of one thing: we are turning in some direction, or we are.

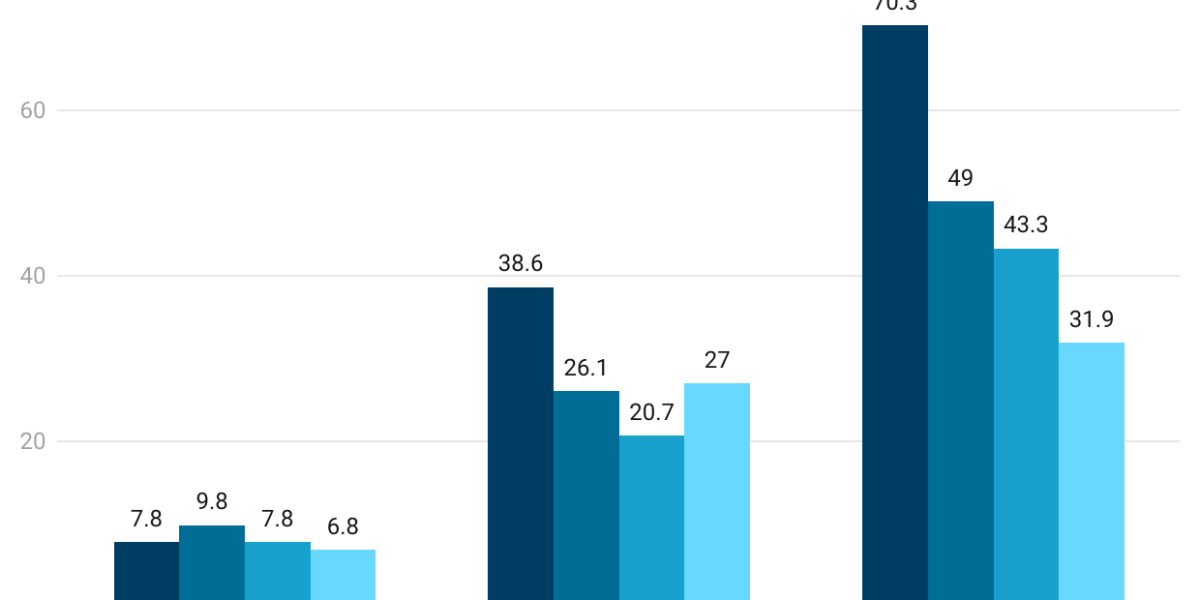

And if you look at PitchBook’s recently published Q3 AI and ML report, there’s actually a lot of evidence that AI companies and investors are in a pretty different position now than they were at the start of the year. Consider, for example, trends around deal value (the total amount of capital invested in a particular sector, in this case) for underlying models.

Honestly, I might have expected this number to drop in 2024, but it’s on the rise and seemingly going up (we’ll know where it stands, as with all these numbers, in the full year report). In general, part of what’s happening is that, in fact, many AI companies have begun to prove their long-term value, especially when it comes to business applications, PitchBook senior emerging technology analyst Brendan Burke said.

“While AI as a technology is still at the beginning of its societal impact, the GenAI push cycle for enterprises may see the end of a string of disappointments and a shift to a productivity plateau,” Burke said via email. “While this market size will not reach the peak of inflated expectations, which predicted universal economic disruption due to the current generation of large language models, large enterprises can make a case for this new technology as they did for cloud computing before.”

Okay, good news, right? Of course, but there are still a lot of questions, especially when it comes to what the exits might look like. (Exit value, by the way, refers to the total value generated when an investor sells shares in a portfolio company.)

So, of course, buyouts are not an option, and acquisitions for AI companies are rarer than they have been recently. That leaves, of course, the most difficult path with the highest reward for AI companies looking for an exit: the IPO. It will be interesting to see how this data changes next year, if the IPO window opens wide again as many hope and expect.

I’ve been particularly fascinated by the decline in late-stage deal values, which right now look set to hit four-year lows. Burke says part of the late-stage problem is that companies before the AI boom struggled to find their way, especially as investors battled their own 2021 hangover.

“Most companies before GenAI were struggling to find their next chapter as their core technology races and investors look for new ideas,” he told Wealth via e-mail. “Of the 546 AI & ML companies that raised at least $100 million in megadeals from 2020 to Q2 2022, only 287 have closed since the VC slump that began in Q3 2022, including acquisitions. “

I can’t help but think it’s a reminder: sometimes what’s old is new again, but sometimes what’s old is, well, old. And regardless, it’s clear that there are still many corners to be ironed out in the AI story.

Next week…Fortune Brainstorm AI is next week! This is my first Brainstorm conference as co-chair, and I’m so grateful to all the amazing investors and companies who will be joining me on stage and at my breakfast roundtable (which, by the way, is already full, as I learned yesterday). If you are curious about the conference, you can find out more here. And to you who are coming, thank you. I honestly can’t wait to see you.

Elsewhere…Olympus Partners, a middle-market private equity firm, returned $3 billion to its investors this year, a person familiar with the situation said Wealth. The majority, or $2 billion, came from Olympus sale staffing firm Soliant earlier this year. Olympus too sold Rise Baking in September, contributing another $1 billion in distribution, the person said. Olympus has generated over $6 billion in distributions as of January 2022. – Luisa Beltran

See you tomorrow,

Allie Garfinkle

Twitter: @agarfinks

E-mail: [email protected]

Submit an offer for the Term Sheet newsletter here.

Nina Ajemian curated the deals section of today’s newsletter. Subscribe here.

ENTREPRENEURIAL WORKS

– PublicNew York-based multi-asset investment platform, has raised $105 million in Series D-2 funding. Existing investor speed led the circle and was joined by others.

– Upwinda San Francisco-based cloud security platform, has raised $100 million in Series A funding. Craft ventures led the circle and joined it TCV, Alta Park Capitalexisting investors Greylock, Cyberstarts, The leader’s fundand others.

– 9finLondon-based AI-powered debt capital market analytics platform has raised $50 million in Series B funding. Mountainous Europe led the round, and was joined by existing investors Spark Capital, Redalpine, Seedcampand others.

– carbmeeBerlin-based developer of AI-powered carbon management software has raised €20 million ($21 million) in Series A funding. CommerzVentures led the circle and joined it Fly Ventures.

– Spota Cambridge, Mass.-based data enrichment platform for non-technical users has raised $1.9 million in pre-seed funding. Asymmetric Capital Partners led the circle and joined it Brenteca investments, Request a VC, CoVentures, Polaris Venturesand angel investors.

– Wexler AIa London-based AI-powered legal fact-finding platform has raised $1.4 million in pre-seed funding. Countless entrepreneurial partners led the circle and joined it Entrepreneur first and angel investors.

PRIVATE CAPITAL

– American Industry Partners bought the US and Canadian architectural coatings business PPGa paint, coatings and specialty materials company based in Pittsburgh, and renamed it Pittsburgh Paints Company. Financial terms were not disclosed.

– Astorg took Hamilton ThorneBeverly, Massachusetts-based provider of assisted reproductive technologies, private and acquired reproductive health company from Cook Medicalthe Bloomington, Ind.-based medical device developer, which will combine with Hamilton Thorne. Financial terms were not disclosed.

– Insight Partners, with the participation of Phillip Hazen and Gerry Coulteracquired a majority stake in Cosmo Techan enterprise artificial intelligence simulation software developer based in Lyon, France. Financial terms were not disclosed.

– Sequoia Financial Groupwith support Kudu Investment Management and Valeas Capital Partnersacquired wealth management practice Eide Bailly advisersa business consulting, accounting and technology firm based in Fargo, ND. Financial terms were not disclosed.

– SYSPROwith support Arrivalarranged the acquisition NexSysa provider of digital production and distribution software based in Manchester, England. Financial terms were not disclosed.

GET OUT

– Pacific Avenue Capital Partners acquired a flooring business HB Fullerglue supplier based in St. Paul, for an expected 80 million dollars.

– ASSA ABLOY acquired Top quality steel doors and framesmetal door and frame manufacturer based in Monroe, La Sargent and Greenleafportfolio company OpenGate Capital. Financial terms were not disclosed.

– Lambert Dodard Chancereul acquired a minority stake in European convenience foodGarrel, a frozen food manufacturer based in Germany, from VR Equitypartner. Financial terms were not disclosed.

THE OTHER

– HB Fuller agreed to the acquisition Medifilldeveloper of wound closure products based in Dublin, i JEWELa medical device manufacturer based in Viareggio, Italy, for 180 million euros ($189 million).

– The Capitol acquired Capitalaba London-based provider of risk management, margin optimization and other financial services BGC Group for 46 million dollars.

– XOMA Royalty acquired Weddingthe Casper, Wyo.-based lung disease developer for $20 million in cash.

– CDW acquired Mission cloud servicesa Los Angeles-based provider of cloud services and solutions for AWS customers. Financial terms were not disclosed.

– Deliver acquired Tabestokiosk for ordering and paying for food based in Paris. Financial terms were not disclosed.

FUNDS + FUNDS OF FUNDS

– Swish Venturesa Tel Aviv-based venture capital fund, has raised $60 million for its second seed fund focused on cybersecurity, cloud infrastructure and artificial intelligence.

PEOPLE

– Clean energy venturesa Boston-based venture capital firm, she added Charlotte Kirk as capital investment. She was previously on Fortescue.