Unlock Editor’s Digest for free

Roula Khalaf, editor of the FT, picks her favorite stories in this weekly newsletter.

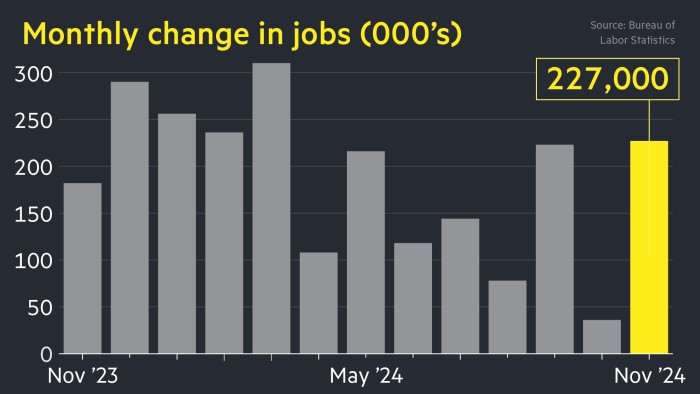

The US economy added 227,000 jobs in November, a strong jump after hurricanes and the attack on Boeing dragged down the previous month’s total.

The figure released Friday by the Bureau of Labor Statistics beat the consensus forecast of 200,000 economists polled by Reuters. The unemployment rate increased by 0.1 percentage point to 4.2 percent.

The growth in the number of jobs in November marked a jump from 12,000 new positions originally recorded for October — the weakest jobs report of the Biden administration. The figure was revised to 36,000 in data released on Friday.

The Jobs Report is one of the last big data releases before Federal ReserveThe meeting from December 17 to 18, where they will decide whether to continue with the third consecutive reduction of interest rates.

Although Friday’s figures beat forecasts, analysts said they were not strong enough to undermine the case for a final rate cut this year.

“Nothing within this release will prevent (the Federal Open Market Committee) from cutting (this month),” said Ian Lyngen, head of U.S. interest rate strategy at BMO.

Gregory Daco, chief economist at EY, added: “From the Fed’s perspective, we are seeing a slight slowdown in labor market momentum, and there is still no major inflationary pressure coming from the labor market.”

“Therefore, I think they will continue with additional rate cuts,” he added.

U.S. Treasury yields fell as investors bet that an interest rate cut by the Fed this month was less likely. Trading in U.S. futures markets showed investors now see a roughly 85 percent chance of a cut later this month, up from a 70 percent chance just before the data release.

The two-year yield, which reflects interest rate expectations, fell 0.05 percentage points to a five-week low of 4.1 percent in late afternoon trading on Friday. Wall Street’s S&P 500 gained a quarter of 1 percent to close at a record high.

Recent data suggests the US economy remains strong and inflation is at risk of slipping above the Fed’s 2 percent target, prompting policymakers to be cautious about cutting rates too quickly.

Fed President Jay Powell he said this week that the Fed may “allow to be a little more cautious” in cutting rates because the US economy is in “remarkably good shape” and inflation is a little higher than previously expected.

Powell’s colleague, Gov. Christopher Waller, warned that progress in reducing inflation “may be stalling,” though he added that supported the December cut. Michelle Bowman, the governor who opposed the Fed’s decision in September to go big with a half-point rate cut, echoed those concerns in remarks Friday, saying the risks of rising inflation were highlighted.

Beth Hammack, the new president of the Cleveland Fed and a voting member of the FOMC this year, said the central bank is “at or near the point where it makes sense to slow the pace of rate cuts.”

“Moving slowly will allow us to calibrate policy to the appropriate restrictive level over time given the underlying strength of the economy,” she added in a speech on Friday.

Still, the rise in the unemployment rate in Friday’s report also signaled a softening in the labor market — a factor likely to prompt the Fed to move forward with rate cuts this month, said Andrew Hollenhorst, chief U.S. economist at Citigroup.

“Powell has sounded quite bullish over the last few months after we had a stronger jobs report for September, and I think he’ll be a little less bullish after this report,” he added.

A cut in December would lower the federal funds rate to 4.25 percent to 4.5 percent. The Fed hopes to achieve a “soft landing” in which inflation moves toward the central bank’s target, without triggering a recession or a large increase in unemployment.

Over the past year, the US economy has created an average of about 180,000 jobs each month. In November, the healthcare, leisure and hospitality, and government sectors were among the sectors that reported the largest gains.

Employment in the production of transport equipment increased by 32,000, which was helped by the end of the strike at Boeing.

Along with upward revisions to October’s jobs numbers, the total for September also rose to 255,000 jobs. Together, employment gains for the two months were 56,000 jobs more than previously reported.