China’s manufacturing activity rose for the second straight month, according to a private survey, a further sign of stabilization after Beijing launched a stimulus package to boost the economy.

Caixin’s manufacturing purchasing managers’ index rose to 51.5 last month, the highest since June, according to a statement released by Caixin and S&P Global on Monday. The expansion was much stronger than the 50.6 economists had forecast and accelerated from 50.3 in October.

The revelation showed that Chinese exports continued to drive the $18 trillion economy’s uneven recovery, even as US President-elect Donald Trump threatened to impose tariffs that could decimate trade between the countries. Official measures activity in November showed a slight increase in the manufacturing sector, while the construction and services indicator unexpectedly fell back to the 50 mark that separates contraction from expansion.

“It could continue to support manufacturing activity going forward for several months until tariffs materialize, which could happen quite quickly given the mechanism in place in the US,” said Michelle Lam, China economist at Societe Generale. WITH.

Buyers’ stockpiling helped new orders rise in November at the fastest pace since February last year, with producer price inflation at a 13-month high, according to a Caixin survey. But employment remained in contraction for the third month in a row, indicating that the effect of the stimulus has yet to pass through to the labor market.

“Although the economic downturn appears to have bottomed out, it needs further consolidation,” Wang Zhe, senior economist at Caixin Insight Group, said in a statement accompanying the release. “The structural and cyclical pressures facing the economy are expected to continue.”

PMI for Asia, excluding China and Japan, was little changed in October, while measures of export orders improved by the most since May, another sign of gains across the region ahead of Trump’s promised tariffs.

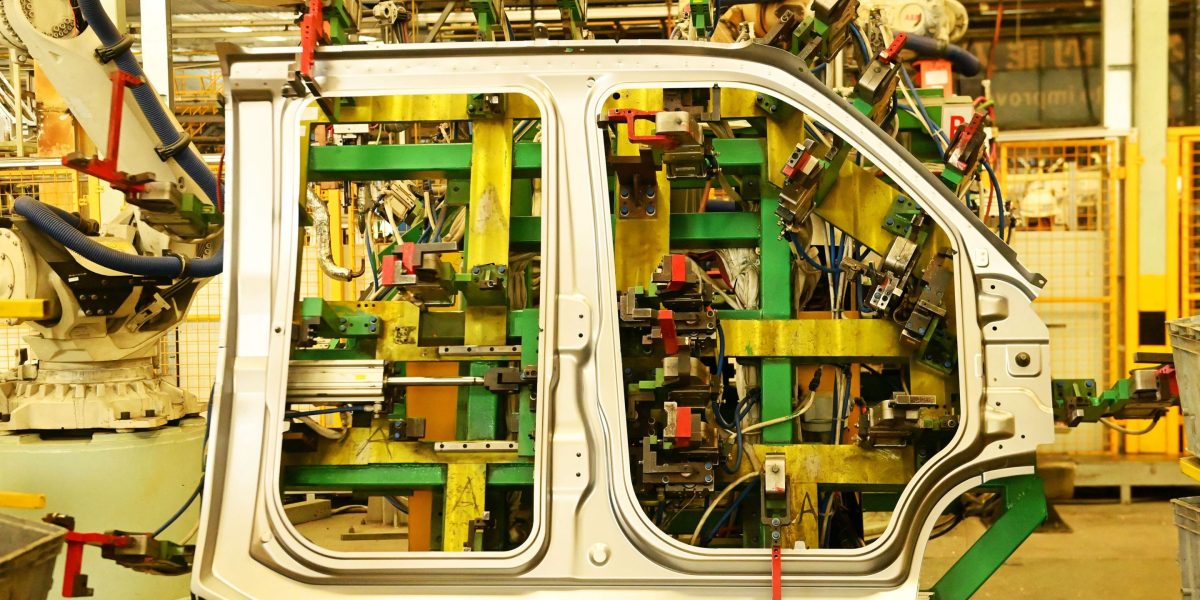

In China, domestic demand benefited from Beijing’s subsidies to buy home appliances, cars and equipment in trade-in programalthough economists say more policy support is needed to maintain growth momentum.

“These plans only boost demand, while real estate transactions will not improve materially unless the outlook for jobs, incomes and inflation improves,” said Kelvin Lam, China economist at Pantheon Macroeconomics.

Caixin’s results are largely stronger than those from the official survey over the previous year as exports remained strong. The two surveys cover different sample sizes, locations and business types, with the private survey targeting small and export-oriented businesses.

Export data released last month showed shipments rose to the second highest on record in the first three quarters, in a boom that has put China on track for a record trade surplus that could reach nearly 1 trillion dollars this year.

At the end of September, China sharply reduced interest rates and presented measures to strengthen the real estate market. That prompted some analysts to raise their outlook for China’s growth in 2024, bringing the median forecast for this year’s growth to 4.8%, according to estimates compiled by Bloomberg.