Unlock Editor’s Digest for free

Roula Khalaf, editor of the FT, picks her favorite stories in this weekly newsletter.

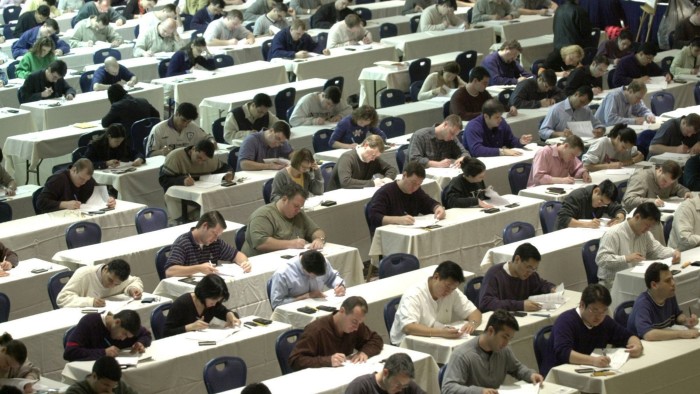

The number of candidates taking the CFA exams has been steadily declining as demand for a qualification once considered essential to the profession declines.

The latest results available for the CFA Institute, which oversees the tests, show that 116,727 people passed all three levels of the exam in the first eight months of this year, down 2,735 from the same period in 2023.

There were 163,000 exam applications last year, down 40 percent from the peak of 270,456 in 2019.

Margaret Franklin, chief executive of the CFA Institute, which oversees the qualifications, said a slowdown in growth from China was partly to blame.

The number of Chinese and Indian applicants has increased in the past decade as graduates abroad seek international investment qualifications that could lead to jobs at US and European investment firms. The number of exam applications in India has doubled since 2014 to 31,600.

China’s growth rate has “slowed down, but before that it was hyperbolic,” she told the Financial Times, adding that “the CFA program is still highly regarded” in the country.

Candidates from India have picked up some of the slack, although she predicts growth from the South Asian country will moderate.

The pandemic has had a negative impact on the number of people trying to qualify, especially among those under China’s strict quarantine regime. The CFA Institute switched to online testing, but it took a long time to establish the new system.

After a sharp drop in registrations during the pandemic, exam results have not recovered. Overall pass rates rebounded to 46 percent, after falling to 22 percent in 2021.

What matters to candidates is whether the CFA will make a difference on the job front, some of whom see it as useful but not necessary.

“You’re not going to hire or you’re not going to hire someone based on having a CFA,” said the head of Emea equity research in London. However, the person said the qualification “helps junior analysts” and that for the first three or four years of their career it is “definitely a positive thing”.

The slowdown comes as structural changes in the asset management industry, such as a shift towards passive investing and private equity, threaten the importance of holding CFA.

CFA Institute introduced new products such as investment certificates in areas such as ESG and climate change. Candidates can now focus on course areas other than general portfolio management, such as private markets and asset management. Case studies within the exam include the cryptocurrency sector.

“We’re diversifying, trying to find things that meet the needs of people at all stages of their careers,” Franklin said.

To encourage more applicants, candidates for the Level I CFA exam can now be up to two years away from completing their undergraduate studies, up from one year previously. Franklin believes the CFA offers a “more meritocratic, less selective” qualification than the more expensive university MBA.

Although she believes the worst of the pandemic has passed, the organization has had to adapt to the slowdown.

“Do I think we will have the same hypergrowth? Not. There is no more hyper growth in business.”