NEWYou can now listen to Fox News articles!

Be careful if you sell online. The Internal Revenue Service Maybe much more about your side this tax season. And the agency pulls it up to those who do not report the added income.

Anyone who earned more than $ 5,000 in 2024 to sell tickets, musical instruments or other goods and services online, would expect a tax form 1099-K this month.

What changes in the tax rules

Online platforms such as Stubhub, Etsy and Ebay previously only had to send these forms to users who in most cases earned more than $ 20,000. From January 1, 2024, payment platforms such as PayPal, Square and Venmo must report payments of a total of $ 5,000 or more in a calendar year, without a transaction minimum. The threshold from 1099-K drops to $ 2,500 in 2025 and finally $ 600 in 2026 unless the IRS brings more changes.

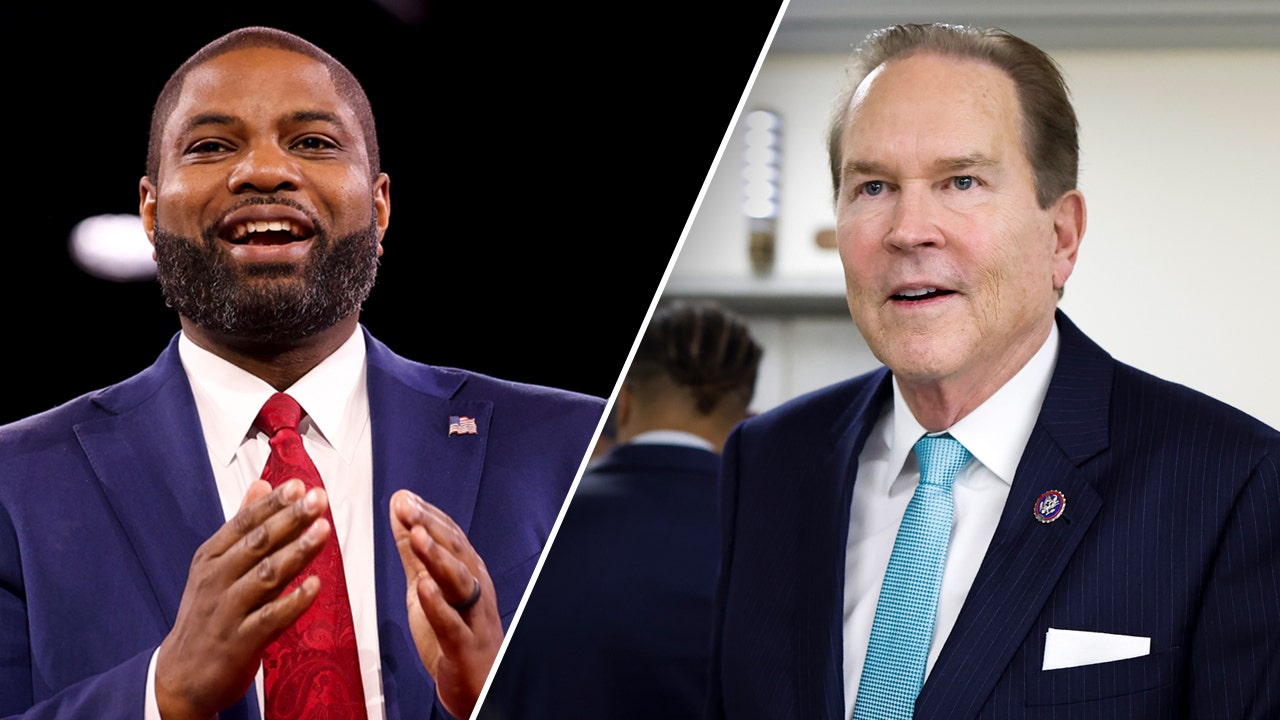

The Internal Revenue Service is about those who do not report their extra income. (Kurt “Cyberguy” Knutsson)

It is time for you to receive your financial home to prove this tax season. The reduced threshold means that forms are sent to millions of more taxpayers to ensure that they express the income in their tax returns.

10 huge ways to make the American economy great again in 2025

“The IRS wants to get the message that they enforce the laws around people who have part -time business on Etsy, Etsy or tickets on Ticketmaster,” said Lee Heisman, a partner at Exit Wealth Advisors in Atlanta.

The threshold should then be fallen to $ 600 The congress has passed on changes To ensure that taxes are paid on income from the performance of performance and selling online concert tickets or other things.

Push the online ticket resellers back

When Online Platforms complained about the extra archiving it needs and the confusion it caused, the rules were delayed. Instead, the IRS chose to intervene the change, making the $ 5,000 threshold for the tax year 2024, $ 2,500 for 2025 and $ 600 for 2026.

Even without the forms, taxpayers had to report all their income to declarations, but many never did. In general, people tend to recharge income when no forms are sent to them. This has been my experience in the past 30 years to give financial advice. Almost nobody lies to their salary income, on the other hand, because the details are reported on form W-2.

Trumponomics will tame inflation – not worse

So this can be the First tax season Where if you sold candles and soap online, have sold part of your sports memorabilia again, or place half of your season tickets for resale, you may have an additional tax assessment.

Who could the IRS focus on?

The IRS has generally had questions for those who never report their online income, and those people who do not report can be confronted with steep fines. The IRS has started an investigation into taxpayers who have earned money as experts on the online platform and reportedly do not accurately report income from 2017 to 2020.

As an example, simply answered experts such as veterinarians and mechanics generally paid between $ 15 and $ 25 for every question they responded. In December, a judge authorized the IRS to issue a summons that only requires an answer to give the names of anyone who earned $ 5,000 or more on the platform in a year in that period in that period, then, then The company apparently did not send 1099 forms.

One taxpayer checked in 2020 Had more than $ 400,000 in non -reported income for four years questions about answering questions, according to the statement of an IRS agent. As part of the investigation, the Agent only identified four answers to users who seem to have not been able to report their just answer compensation on their tax returns. It is suspected that the non -reported income of more than $ 1.3 million has earned by answering more than 86,000 questions.

Click here for more the opinion of Fox News

When is it a hobby and when is it a company?

Whether you get a 1099-K or not, when you start generating income, you must consider this a company. This is true, even if you only sell $ 2500 in products or tickets on one of the online sales market.

In my opinion it is always a best practice to have a separation of church and state. This means that you must set an official LLC or plan to submit a schedule C, set up a separate credit card and to set a separate bank account. In this way you can make a definition of your company to sell items online, away from the day to day of your personal finances.

In general, if your company claims a net loss for too many years (three out of five) or does not meet other requirements considered by the IRS, it can be classified as a hobby. When the Irs thought That it is a hobby, then all your business deductions can be rejected.

Click here to get the Fox News app

What would Taylor Swift say? “It’s me, I’m the problem!”

Being ignorant about changes in tax legislation and telling the IRS that you did not know will not be a suitable defense if you are checked. If you earn money at all trade collectibles, selling tickets or living on your side on Etsy, it is important that you will change these rules before 2024 and in the coming years in 2025, 2026 and then.

Hopefully the IRS will never be an auditBut if they do that, you can prepare to put your “tax” ducks in line and get ready!